Más Información

SEP debe informar sobre objetos peligrosos en revisiones escolares: Inai; violencia escolar ha ido en aumento

Videojuegos, el nuevo gancho del crimen para captar menores; los atraen con promesas de dinero y poder

“Vamos a dar apoyo a los pequeños agricultores por sequía en Sonora”; Claudia Sheinbaum instruye a Berdegué

During the current administration, oil investments in Mexico could exceed MXN $1.1 trillion.

According to information to which EL UNIVERSAL had access, the economic impacts include resources corresponding to the new exploratory strategy of oil fields state oil company Pemex wants to develop and that is part of the investment program that the federal government will present in February and in which private capital will be able to partake in.

Another part corresponds to the calendar of resources jeopardized by Pemex to keep the productive activity of at least 10 of the main producer fields from where the current production is extracted and the one of blocks granted in previous bidding rounds for the private initiative .

Did you know

?

As part of the Pemex six-years investment program , companies will be hired through service contracts for an approximate of MXN $324.9 billion in 2020 and 2024 .

The state oil company will disburse investments superior to MXN $776.5 billion in the current administration to maintain the operation of the 10 main oil fields that currently supply the biggest volumes of crude oil in Mexico , according to the financing calendars and the assessment horizon of these assets registered in the Finance Ministry (SHCP).

In the next six years, the Ku-Maloob-Zaap asset requires investments superior to MXN $223.8 billion , Cantarell, MXN $181.7 billion ; Chicontepec or Gulf Tertiary Oil, MXN $98.4 billion ; Chuc MXN $70.4 billion ; Light Sea Crude MXN $51.8 billion ; Integral Veracruz MXN $40.1 billion ; Yaxché MXN $34.4 billion ; Antonio J. Bermúdez MXN $26.2 billion ; Ogarrio-Sánchez Magallanes MXN $25.4 billion , and Jujo-Tecominoacán, MXN $23.8 billion .

Did you know

?

The new exploratory activity to be developed by Pemex, including associates, is focused on the drilling of 470 wells of conventional fields, lands, and shallow-waters.

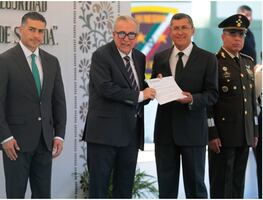

Pemex CEO, Octavio Romero Oropeza

, added that in 2020 the drilling of 60 oil wells is planned as part of the exploratory strategy for which USD $2.7 billion are required.

Have you heard

?

Increasing investment

In 2021, 80 oil wells will be drilled and the required investment ascendS to USD $2.7 billion ; in 2022, the same number of units will be drilled but they will need USD $2.8 billion ; for 2023, 100 oil wells are planned with a capital of USD $3.3 billion , and for the end of the administration, 110 oil wells are contemplated for USD $3.5 billion .

The portfolio of projects in which private capital can partake includes, among others, the assets of Ixachi, Kmz-Ayatsil-Tekel-Utsil, Xikin, Quesqui, Pokche, Valeriana, Zama, Esah, Nobilis, Koban, Doctus, Exploratus, Octli, Área Contractual 2 Perdido-Salina del Bravo, Maximino, Área Contractual 18 Tampico-Misantla Veracruz, adjacent land blocks, Tizón, Suuk, Cahua, Miquetla and new land areas.

Have you heard

?

With the development of these assets and traditional fields, Pemex has outlined the goals of crude oil production from 1,710,000 daily barrels in 2019 to 2,816,000 barrels in 2024.

Regarding the private initiative that operates blocks obtained in previous bidding rounds, the National Fuel Oils Commission (CNH) , reported that, according to exploration and development plans for extraction related to contracts approved by the regulator, it forecasts the drilling of 470 oil wells during the same period.

Did you know

?

mp