Más Información

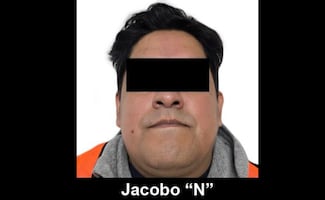

Vinculan a proceso a "El Yeicob", socio del empresario Raúl Rocha, por delincuencia organizada; le dictan prisión preventiva

Vinculan a proceso a "El Limones" por narcotráfico y posesión de armas; continúa en prisión en el Altiplano

UIF respalda sanciones de EU contra el Cártel de Santa Rosa de Lima; fortalece esfuerzos conjuntos para reducir criminalidad, destaca

By unanimous consent agreement, Mexico’s Senate approved on Tuesday, a bill that would regulate its fast-growing financial technology sector , including crowdfunding and cryptocurrency firms , paving the way for a vote by the lower house.

The bill, which seeks to promote financial stability and defend against money laundering and financing of extremists, is expected to pass in a final lower house vote by December 15 .

If it is approved, the finer details would be hashed out in so-called secondary laws.

The new measures will allow Mexico to join a small but growing list of countries, including the United States and Britain, that have sought to regulate FintTech firms .

Financial services firms see major potential growth in Latin America’s No. 2 economy by reaching the more than 50 percent of Mexico’s roughly 120 million citizens without bank accounts.

On Twitter , National Regeneration Movement ( Morena ) block wrote: “A step towards financial inclusion and the fight against corruption,” regarding the bill's approval.

The Party of the Democratic Revolution ( PRD ) wrote: “The FinTech Law provides legal certainty and ensures innovation in financial services,” a quote from Senator Isidro Pedraza .

Senator Gerardo Flores

( Institutional Revolutionary Party abbreviated PRI ) said: “The Fintech Law places Mexico among the countries leading consumer protection, preserving financial stability, competitiveness promotion, and money laundering prevention.

The bill aims to set out clear rules and reduce costs to users. That should drive competition in a sector that includes crowd-funders and payment firms, it says.

The bill also proposes measures to regulate firms operating with virtual currencies like bitcoin. The central bank would be tasked with refereeing such operations.

If the Fintech Law is approved, the growing use of the cryptocurrency will be regulated by the Bank of Mexico ( Banxico ).

Felipe Vallejo

, Director of Public and Regulatory Policy at Bitso , an exchange platform for cryptocurrencies including bitcoin, said that the bill brings Mexico in line with other countries.

“For us, it was a victory for the sector, because this is being done internationally,” Vallejo said.

Chicago-based CME Group

, manager of the largest derivatives and futures market in the world, said last week that it will start offering bitcoin derivatives, and Nasdaq Inc. plans to launch a bitcoin-based futures contract next year.

Financial technology

( FinTech ) is the new technology and innovation that aims to compete with traditional financial methods in the delivery of financial services through the use of smartphones for mobile banking and investing services which seek to make financial services more accessible to the general public.

sg

Noticias según tus intereses

[Publicidad]

[Publicidad]