Más Información

“Vamos a dar apoyo a los pequeños agricultores por sequía en Sonora”; Claudia Sheinbaum instruye a Berdegué

Derrota de México en disputa por maíz transgénico contra EU; estos son los argumentos de Sheinbaum y AMLO para prohibirlo

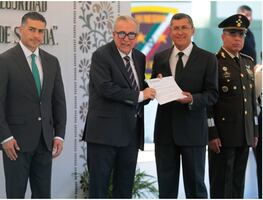

Óscar Rentería Schazarino, ha operado contra CJNG, Viagras y Templarios; es el nuevo secretario de Seguridad en Sinaloa

Claudia Sheinbaum pide respeto para Maru Campos; gobernadora anuncia acuerdo para transporte público

Claudia Sheinbaum anuncia los Centros de Cuidado Infantil en Chihuahua; inaugura hospital en Ciudad Juárez

In the current year, Mexican tax authorities have collected MXN 27.828 billion from tax evasion and fraud both from big and medium-sized companies.

Although the most famous cases involved those of América Móvil , Walmart , IBM , and Femsa , who complied to Mexico’s Tax Administration Services (SAT) , there were previous ones that did not receive as much attention but who had to compensate the damage they had caused for evading taxes with invoices to simulate operations.

Their names went unnoticed since they do not figure in Mexico’s Stock Market and, therefore, are not liable to report it to the public. Although they did it through other outlets, it did not have the same mediatic effect , however, they paid MXN 2 billion .

Recommended: Femsa agrees to pay $8,790 million in taxes to Mexico

In addition to paying their liabilities, the agreement included announcing they did wrong and to urge taxpayers not to follow their steps,

Through edicts published in national newspapers, these companies confessed to their tax evasion .

Mea Culpa

This year, Simec International , which is part of the iron group Simec , published an announcement confirming it had struck a deal with Mexico’s Finance Ministry .

The text included the following call: “ Taxpayers are invited to comply with their tax liabilities and reach authorities to solve their doubts.”

The same was done by steel company Orege S.A. de C.V. , manufacturing firm Perfiles Comerciales Sigosa , Siderúrgicos Noroeste , and Simec Acero .

Recommended: IBM agrees to pay MXN $669 million in taxes to Mexico

To the MXN 2 billion, we must add the payments from big renowned taxpayers .

In some cases, they used the capital repatriation program through which they paid and ISR tax of 8% instead of 30%

América Móvil

was the first company to pay its debt to the SAT this year.

The telecoms firm, which is owned by Carlos Slim, paid MXN 8.290 billion for a change in a tax regime that implied deferred taxes from 2016 and 2019 .

Recommended: Walmart Mexico pays the Mexican government over MXN$8 billion in back taxes

paid MXN 8.079 billion on taxes related to the sale of the Vips restaurant chain.

Then, FEMSA , Coca Cola’s bottler and owner of Oxxo convenience stores, paid MXN 8.79 billion .

For its part, IBM struck a deal to pay MXN 669 million .

All these payments comprise a total of MXN 27.828 billion that has been collected by Mexico.

Recommended: Tax evasion by multi-national companies halts development in Mexico

mp