Más Información

Videojuegos, el nuevo gancho del crimen para captar menores; los atraen con promesas de dinero y poder

“Vamos a dar apoyo a los pequeños agricultores por sequía en Sonora”; Claudia Sheinbaum instruye a Berdegué

Derrota de México en disputa por maíz transgénico contra EU; estos son los argumentos de Sheinbaum y AMLO para prohibirlo

Countries throughout the world have a central scheme to obtain resources and offer services to the population: taxes . In France in 2018, its tax revenue represented 46.1% of the wealth generated that year; moreover, this was the highest percentage in the world.

According to the OECD , Mexico’s tax collection in 2018 amounted to 16.1% of the GDP. In Latin America, several countries have a higher tax revenue than Mexico: Cuba, Brazil, Argentina, Uruguay, Costa Rica, El Salvador, Nicaragua, Honduras, Chile, and Ecuador.

Although a higher tax collection doesn’t always guarantee efficient governments or high-quality services, this is the first step towards improving the country.

In Mexico , the working class is the main taxpayer through its income tax and the consumption tax. Meanwhile, large companies received preferential treatment, they were given tax pardons and tax waivers for over MXN 500,000 million.

Recommended: Femsa agrees to pay $8,790 million in taxes to Mexico

For years, Mexico’s tax culture has consisted of avoiding to pay taxes or trying to reduce the figures, which was often achieved. Large companies and consortiums spent a lot of money on tax lawyers and trials to avoid their obligations.

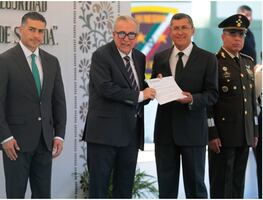

The current government promoted laws to avoid preferential treatments. Companies that owed millions in taxes are now paying their debts. In 2020, the public purse has obtained MXN 28,000 million after pressing tax evasion and fraud charges against large and medium-sized companies. The agreement reached by both parties included paying their debt and publicly acknowledging that their behavior was wrong and urging people not to follow their previous example.

Furthermore, tax collection has to do with social justice and the redistribution of wealth ; therefore, it is positive to eradicate exceptions and special treatments.

In exchange, citizens and companies must make sure that public services improve. Beyond welfare programs to create clientele policies, the country requires better security, education, and health services. This would be the best motivation to generate a new tax culture.

Recommended: This is why Wal-Mart paid millions in taxes to the Mexican government

gm