Más Información

“Vamos a dar apoyo a los pequeños agricultores por sequía en Sonora”; Claudia Sheinbaum instruye a Berdegué

Derrota de México en disputa por maíz transgénico contra EU; estos son los argumentos de Sheinbaum y AMLO para prohibirlo

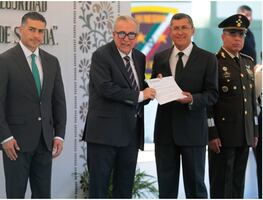

Óscar Rentería Schazarino, ha operado contra CJNG, Viagras y Templarios; es el nuevo secretario de Seguridad en Sinaloa

Claudia Sheinbaum pide respeto para Maru Campos; gobernadora anuncia acuerdo para transporte público

Claudia Sheinbaum anuncia los Centros de Cuidado Infantil en Chihuahua; inaugura hospital en Ciudad Juárez

In regards to taxes , Mexico registers huge gaps, as well as in social and development issues. There are geographical areas and sectors that have more benefits than others. The salaried employee automatically pays taxes through deductions made to their paycheck , in contrast, large consortiums have received quitclaims and debt cancellations worth millions. The contrast becomes even more evident

Today, EL UNIVERSAL reveals that from the 21 companies that signed contracts with Pemex Exploration and Production ( PEP ), 9 of them also received tax cuts for MXN $5,500 million. This double benefit raises questions about its legality .

These companies were favored with PEP contracts when the head of the division was accused of asking for bribes to assign contracts, moreover, these companies also appear on a list released by the Tax Administration Service ( SAT ) a few weeks ago, where the tax write-offs granted by the Felipe Calderón and Peña Nieto 's administrations are revealed, which are calculated in MXN $247,000 million, applied to 9,000 taxpayers .

In September 2019 , the lower chamber modified the 28th constitutional article to ban the President from granting tax write-offs and exemptions. The measure is now in the Senate and it will represent an increase in tax collection but the authorities will have to go beyond so that the number of taxpayers increases and so that salaried employees are not the only ones who pay taxes .

For example, in regard to the informal economy , there is a chance to expand the number of taxpayers . There are millions of people throughout the country, who occupy public places to commercialize products every day, without contributing to the national finances . On the other hand, merchants leaders take advantage of the situation and request payments that end up in their pockets or are given to corrupt authorities .

The similarities between l arge companies and street vendors include the fact that until now, both of them avoid paying taxes , a practice that should be eradicated. In Mexico , one of the pending issues is tax equity . How long will it take to implement it?

gm