Más Información

Videojuegos, el nuevo gancho del crimen para captar menores; los atraen con promesas de dinero y poder

“Vamos a dar apoyo a los pequeños agricultores por sequía en Sonora”; Claudia Sheinbaum instruye a Berdegué

Derrota de México en disputa por maíz transgénico contra EU; estos son los argumentos de Sheinbaum y AMLO para prohibirlo

Under pressure from President Donald Trump, Mexico is preparing to discuss changes to trade rules about a product's country of origin to try to avoid a disruptive fight with the United States over commerce.

As the two countries begin a difficult new relationship, Mexico sees possible common ground with Trump on the "rules of origin" of the North American Free Trade Agreement (NAFTA) that binds the two countries and Canada, several sources said.

Rules of origin are regulations setting out where trade products are sourced from. Although formal negotiations about NAFTA have not begun, the rules could eventually be altered to favor U.S. industry over competitors from outside North America, particularly in Asia.

Changes to those rules could help align Mexico with Trump's industrial strategy of boosting U.S. manufacturing jobs and dovetail with the Mexican government's calls to strengthen North American competitiveness.

It could also help pave the way for a broader deal with Trump over border security and immigration, Mexican officials believe.

Talks about NAFTA rules of origin will be a "very important" point of discussion between the two countries now that Trump is in office, a Mexican official said. The White House did not reply to requests for comment on the issue.

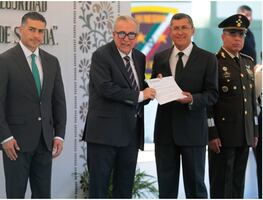

Mexican Foreign Minister Luis Videgaray and Economy Minister Ildefonso Guajardo will hold talks with top Trump officials in Washington on Wednesday and Thursday, where security, migration and trade will be discussed.

Fears of economic disaster have haunted Mexico since Trump won the presidency in November threatening to tear up NAFTA, impose protectionist tariffs and build a wall on the United States' southern border to halt illegal immigration.

While Mexico is reluctant to alter the 1994 trade accord, officials concede that some changes may be necessary to help keep trade open with the United States, which absorbs 80 percent of its exports.

"What we want is to maintain free access for Mexican products, without restrictions, without tariffs and quotas," Videgaray, the spearhead of the government's outreach to Trump, said on Monday.

LESSER EVIL

Speaking on condition of anonymity, two Mexican government officials and four other people familiar with ongoing discussions said Mexico saw rules of origin as an important avenue to brokering a deal with Trump, provided a fair compromise can be reached.

In trade agreements, content rules or rules of origin are often used to determine import duties.

Under NAFTA, 62.5 percent of the material in a car or light truck made in Mexico must be from North America to be able to enter the United States tariff free.

If the countries agree in negotiations, that percentage could be increased, potentially giving an advantage to U.S. industry at the expense of Asian competitors.

For Mexico, changing the rules of origin could be a lesser evil than Trump's threat to impose a 35 percent tax on certain goods made by foreign companies in Mexico for sale in the United States.

Trump's pressure on U.S. automakers such as Ford to build more cars at home worries Mexico, where the industry has been one of the main drivers of growth and accounted for 18.5 percent of manufacturing GDP in 2015.

Trump on Tuesday told the chief executives of the Big Three U.S. automakers - General Motors, Ford and Fiat Chrysler - that he wants to see more auto plants in the United States.

Mexico warned it could pull out of NAFTA if a renegotiation of the pact does not benefit it.

Trump's team is behind the push for changes in the origin rules, seeing it as a means of reducing imports from China, two of the Mexicans familiar with the matter said.

Trump's nominee for Commerce Secretary, Wilbur Ross, spoke of the importance of content rules in protecting the automotive industry during Senate hearings last week, and Canadian media reported that Ross had told Canada rules of origin would be central to NAFTA talks.

U.S. HARD LINE

NAFTA rules of origin apply to goods made in any of the three countries. Two Mexican sources said the Trump administration could push for national content requirements that would ensure that the United States benefits from changes in rules of origin, and not just the NAFTA region as a whole.

However, that would be more complex to manage, they added.

So as not to hurt companies, any changes would need to be phased in gradually, and the more items that were targeted, the trickier negotiations would be, one of the sources said.

Any deal would need to ensure rules changes applied to all countries, not just to Mexico, one Mexican official said.

Of the foreign carmakers in Mexico, Toyota might be able to handle a higher NAFTA content ratio better than others. It Camry car, for example, has very high North American and U.S. content.

Other Japanese automakers such as Mazda have a larger proportional reliance on Asia-based suppliers.

Kristin Dziczek, a labor analyst at the Center of Automotive Research, said deepening rules of origin could have some impact on U.S. jobs and would hit some foreign automakers harder - especially those that produce more parts and vehicles outside North America.

The NAFTA rules are in place to prevent China or other lower wage countries from being able to produce the majority of content in a vehicle and export it to another country to assemble it without paying tariffs.

U.S. automakers have not backed tougher rules of origin previously because they wanted flexibility on sourcing parts.