Más Información

Claudia Sheinbaum reabre segundo piso del Museo de Antropología; rinde homenaje a culturas indígenas y afromexicanas

Identifican a mexicano muerto en tiroteo en Consulado de Honduras en EU; evitó la entrada de migrante armado

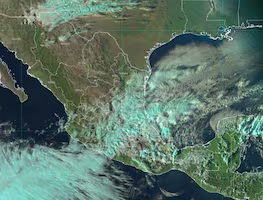

Frente frío 21 y tormenta invernal golpean México; alertan por caída de nieve, aguanieve y temperaturas bajo cero

Brazil's central bank ordered the liquidation of the local unit of Mexican billionaire Ricardo Salinas Pliego's Banco Azteca SA, after eroding finances and the breach of industry rules led to successive losses.

The central bank said in a statement on Friday that the deteriorating situation of Banco Azteca do Brasil SA left depositors and creditors subject to "abnormal" risks. Azteca do Brasil had one functioning branch and owned 0.0005 percent of Brazil's banking assets and 0.0009 percent of total deposits.

The central bank is "taking the appropriate measures to assess responsibilities," it said in the statement.

The bank's parent company Grupo Elektra SAB said in a statement on Friday afternoon that the closure of its Banco Azteca operations in Brazil was advancing after it said in May it would begin pulling out.

Salinas Pliego, whose fortune is estimated at US$4.5 billion by Forbes Magazine, opened the local unit of Azteca in the city of Recife in 2008 as part of a broader effort to expand his Elektra retail chain in Brazil's Northeast. In recent years, consumer spending in the once-booming region been losing momentum, hammering both Elektra and Banco Azteca.

The central bank has been tightening oversight of banking and brokerage firms during the industry's worst crisis in almost two decades. Banks in Brazil are grappling with the country's deepest recession in at least 25 years, rising borrowing costs and fallout from a corruption scandal at state companies that triggered loan renegotiations and defaults.

Banco Azteca operates in five Latin American countries.

According to the central bank, 68 percent of Banco Azteca do Brasil's deposits are backed by guarantee fund FGC, a privately held institution funded by banks operating in Brazil.